The last post on A|HEAD|ahead is from May 2016, this is 1.5 years ago. Did I lose appetite in writing? Not at all, but activities shifted. Many ideas first posted here, e.g. the 7-part series on the ‘new impetus’ for reporting (posted here between March 8 and May 11, 2016), advanced and made it into the Reporting Blueprint of Reporting 3.0. Since then I have written more than ever. The four Blueprints of Reporting 3.0 are each about 100 pages of packed research, insights, recommendations and tools for a new take on reporting, data, accounting and new business models, all content to be found at www.reporting3.org. The Reporting Blueprint (me as the lead author) and the Data Blueprint (authored by my colleague and friend Bill Baue) are released, the Accounting Blueprint (with Cornis van der Lugt as lead author) and the New Business Models Blueprint (with Bill and myself as co-authors) are still in the process for release at the 5th Reporting 3.0 Conference in Amsterdam on June 12/13, 2018, hosted once more by KPMG. In parallel we also posted a ten-part series on Sustainable Brands, now also available as an eBook here. By the end of 2017, and looking ahead to another important year for Reporting 3.0, I’d like to revitalise my A|HEAD|ahead blogging for those things that go beyond the purely professional Reporting 3.0 work, but not right away, so stay tuned for that. I’d like to start with a broad review of what 2017 has taught me. 5 points come to mind:

- All research and reviews that we’ve undertaken in our professional work indicate that we need a new layer of institutions to solve our biggest problems. Luckily, this is already happening, and therefore I am happy to see a new collective consciousness arising in which many of the existing institutions also understand (often without admitting) that just being part of a puzzle doesn’t automatically lead to finalising the task of completing the puzzle. Examples are the foundation of a World Benchmarking Alliance, with the potential to create a streamlined and standardised way to compare truly sustainable performance; the creation of an Earth Commission (a program initiated by GEF, WRI, IUCN, WEF, IIASA and SRC), broadening the idea of globally applicable thresholds (carrying capacities) of all natural resources, and Reporting 3.0 itself as a pre-competitive and market-making work ecosystem to prepare for the necessary change of economic system design, potentially the biggest lever to not only rely on sustainability leaders, but to create scalability of impacts through incentivised followership. There are many more of these examples for sure, but these are closer to my and our work.

- As a result of this development there is now an even clearer articulation of the shortcomings of existing structures. While the business sector leans back and sings the choir of the SDGs and the Paris Climate Treaty as the ‘thresholds per sé’ upon which all action is now focused on, a more systemic approach shows that much more is needed beyond those given achievements. The SDGs lack a scalability potential as they mainly focus on a set of goals that aim to optimise a knowingly failed economic paradigm in which the rich get richer and the built-in hoaxes called ‘homo oeconomicus’ and ‘trickle-down-economics’ are still playing their disastrous game, happily embraced by e.g. the Trump regime in the US. They are tearing us apart in all means of life. Merely focusing on implementing the SDGs without tackling economic system design change is not creating the level of followership needed to create enough global impact at the level of speed that is needed. Alex Steffen has started a series of blogs on what he calls ‘predatory delay’, I recommend to read this one in particular. Aligned to this there is more and more recognition that we need to focus on a 1.5 degree (or below) global warming target than a 2 degree target if we want to escape the uncontrolled upward spiral of climate change. It is amazing to see how little perception is developing that the Paris Climate Treaty, even at 2 degree global warming target, is a deep and rough transformation agenda for businesses and that investors would be best suited to demand transition plans from the organisations they are invested in (an idea cultivated by Reporting 3.0 partner Preventable Surprises). Compare the urgency of speed to the reality, exemplified by the recent IIASA report ‘Two thirds of major emitting countries not on track to reach their climate targets’ when it comes to countries, so don’t expect things to be different in companies. The climate science itself is also very little connected to the economic system design change needs, at least there is an appeal to internalise external effects, but that plea is already 40 years old and since then bedevilled by economists everywhere. But, as #1 above shows, there is hope! I am however still mourning that there was not enough political will to demand a SDG # 18 – change economic system incentives towards regeneration and thriving.

- At Reporting 3.0, while developing and writing the Blueprints, we have decided to focus on building some necessary glue through what we call the Global Thresholds & Allocations Council. It became so blatantly obvious that the blind flight in sustainability is due to the missing implementation of sustainability context. Simply speaking there is much focus on the numerator data of an indicator that completely misses the denominators in order to be able to make a valid assessment how ‘sustainable’ any organisation on this planet truly is. Technically speaking we need a) science-based or norm-based thresholds (that is nicely linked to Kate Raworth’s ‘Doughnut Economics’, my recommended book of the year) in natural, social, human and economic capital spheres, as well as b) the globally/regionally/locally accepted allocations of those available capitals. It is amazing to see how much hardly everybody refuses to think of allocations while they happen all the time, but without proper thinking behind it. Partially the tragedy of the commons, but partially also cultural and educational blindness. Time to move on and open the eyes through a proactive and storytelling way should help pave the road ahead. Wish us luck in getting the GTAC up and running. At least having clarity around the data, levels and benefits of fulfilling the sustainability context challenge would already be a great success (in order to have a glimpse of an idea what ‘impact’ really means), the rest is purely political and societal will of wanting and getting used to this boundary setting as a pre-step to economic system design change.

- I have tested this throughout the year, and nobody really opposed: my answer to what ‘economic system design’ now practically means. A ‚grand design’ for the redefinition of economic system boundaries is hardly anywhere captured in its totality. There are existing pieces of the necessary patchwork covered in various fora, but the discussion among sustainability experts is close to non-existing when it comes to linking individual performance to economic system conditions. Language barriers, know-how barriers, a failure in addressing such topics to the right people within the organization to establish a proper discussion culture, lead to non-coverage. Deliberations from various Reporting 3.0 discussions about trying to reduce the complexity to an absolute but necessary minimum of ‚intervention points’ boiled down to mainly four areas in which economic system conditions and incentive structures need to change to allow for a green, inclusive & open economy, delivering market conditions that would automatically lead to minimally neutral, but more likely positive impacts:

a) Adjusting cost accounting to cover the true cost of nature use and abuse, diminishing the ability of future generations to live a life with equal opportunities, respecting the idea of setting precautionary measures to ensure the intra- and intergenerational equity condition of sustainability. This has impacts on natural capital and manufactured capital and needs the monetization of the earth’s services, which is by far not a new topic. This won’t automatically lead to increased cost, a complaint often made by corporations, it will mainly be an incentive for true cost avoidance (not in the sense of ignoring external costs in the first place) in order to offer sustainable goods at a lower price than unsustainable goods. This would potentially help solve the stagnant amount of customers to buy the better – because (in the end) cheaper – sustainable goods. The same logic applies for social costs consequences that are often following the restrictions of nature overuse (see e.g. the current costs for the integration of climate refugees in many parts of the world).b) Introducing benefit accounting for the appreciation of positive impact, part of a total contribution system of accounting. This would include the monetization of positive increases in social capital, human capital, reputation capital and intellectual capital. The same applies for envionmental benefits, accounted for through natural capital and manufactured capital.

c) Translation of these true costs and benefits into true prices and not keeping them hidden in shadow calculations. There are many companies that already use such shadow calculations as internal pricing mechanism, but do not add them to products yet. As said we expect innovative solutions to avoid the negative costs as a generic incentive to create net positive or gross positive products, so that they can be offered at a cheaper price than products that burden the environment or society. As a market mechanism absorbs the pricing signals it gets and prices also represent a value system the market mechanism is based upon, a capitalistic market system can indeed help customers ‚to do the right thing’ when choosing the cheaper options, meaning the more sustainable one. It can also allow the customer to still choose an unsustainable option, but at a price. This of course is only possible when industries accept and build these assumptions into a new global or regional level playing field. What holds us back so far are aspects of competition, power, and (partially accepted) abuse. We also see this part as a crucial necessity to achieve and to unlock the 25 years of expensive testing of how to change the behavior of customers. As long as pricing signals are the main driver for buying decisions, scalability of sustainable solutions can only be achieved through such market-based pricing levers.d) Changes in the incentive structures through taxation. This would mean to signal a decrease of taxation on labor and an increase of taxes for non-renewable resource use. This can be done in combination with true costing mentioned above (leaving it partially to the regulatory power of governments to include every goods and services producing enterprise and let them become necessary followers of such taxation). This attempt also includes subsidies and other possibilities of tax cuts that can be granted for sustainable behavior. Of course, it would be beneficial to discuss these movements on regional and global scale and insert them in bilateral and multi-lateral trade agreements, an area of utmost friction between the different continents and political forces, but we can’t refrain from the fact that if business asks for it on the basis of creating fair and equal level playing fields, it can be done.Summing up, we see a specific advocational role for the already often quoted ‚leaders in sustainability’ and governments as the legislatory power to support societal consense through necessary laws, representing mainly the ‚bottom line’ of such new level playing fields. When corporate leaders explain the need that everybody in their industry must be following their lead, a voluntary solution will most likely not move the whole industry. Stepping into such a change agenda doesn’t imply a total switch at a certain point in time, a staggered approach following the convention building and new (academic and innovation) insight. We acknowledge the fact that this is most likely a ‚generational issue’, but we also recognize we only have one generation left to make those necessary changes. It is therefore necessary that end goals and timelines need to be negotiated from the outset. - Closing this post and referring back to the starting point about a growing collective consciousness of what is needed above and beyond existing institutional design, this year has been revealing on many other fronts. It is strange to see how the existing economic paradigm is keeping us hand-cuffed. This reality does not even stop at the level of NGOs and foundations, those that once started out to ‘save the world’. These whole ‘sectors’ are so cut into issue-specific pieces that hardly anybody really oversees the whole systemic connectedness, even more a reason why it needs the pre-competitive and system-relevant thinking. I developed a very deep gratitude for the few that see ‘the whole’ and who funded the work of Reporting 3.0 in 2017 and will continue to do so in 2018. I have developed a rather thick skin for those that simply don’t want to learn, calling what we do ‘academic’ or ‘pie in the sky’. I tend to ask them what their alternative solution then is, and that is normally when it becomes rather quiet or they start to praise their own incrementalism which can be torn apart with 1-2 more questions (sorry if I stepped on anyone’s toes here). We have only seen the glimpse of the possibilities beyond ‘sustainability as usual’, of regeneration and ThriveAbility. I see how lost most are when you address aspects like prosperity and intergenerational equity, once essential but now forgotten preconditions of sustainability (we perverted the original concept to making it fit into an existing economic paradigm); or the understanding that incrementalism is part of the problem; or the fact that risk aversion in all sorts of hierarchies avoids seeing through; or the understanding that we suffer the ‘illusion of separation’ as my good friend Giles Hutchins has coined it and written a book about it (another recommendation to read). At Reporting 3.0 we have coined the mental mindset and world view needed to be that of a ‘positive maverick’. I think we can now say within 5 minutes if anyone fits that category or not. 2017 have brought us many new positive mavericks, others mentally unsubscribe. In a way this is clearing the mist.

I am thankful for the great meetings in 2017, the good discussions, the great team members at Reporting 3.0. I’d like to especially thank Bill Baue for thoughtful editing of a lot of what Reporting 3.0 published this year and thereby increased much extra depth into my writing; he is not just a wonderful friend and colleague to work with, he’s one of the most positive of all mavericks I know on this spaceship called Earth.

I wish all of you positive mavericks out there to have a bit of time to reflect on what we can achieve together in 2018. The look into our children’s eyes shows all the worth of it. They deserve it, and we need to deliver.

Happy Christmas and a wonderful turn of the year to you and your families!

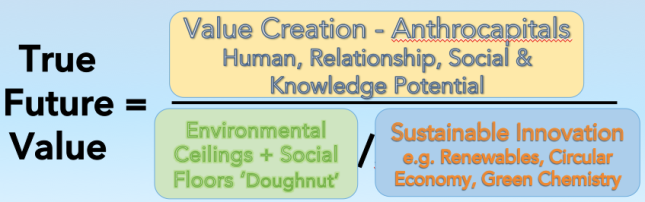

Diagram 6: High-level formula for deriving at ‘True Future Value’; a more detailed version with all variables can be sent by the author on request.

Diagram 6: High-level formula for deriving at ‘True Future Value’; a more detailed version with all variables can be sent by the author on request.

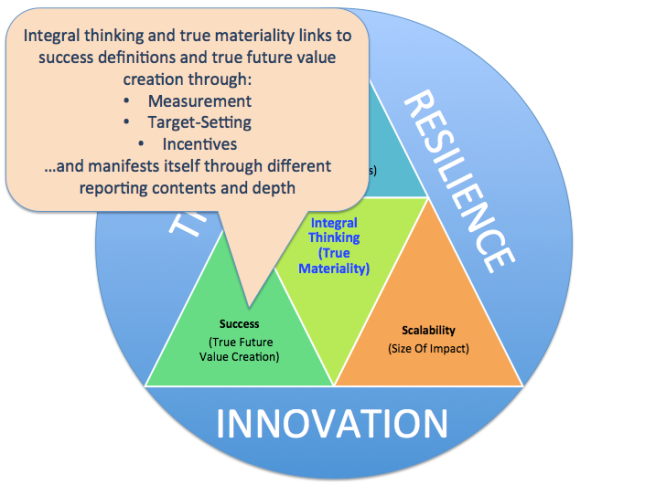

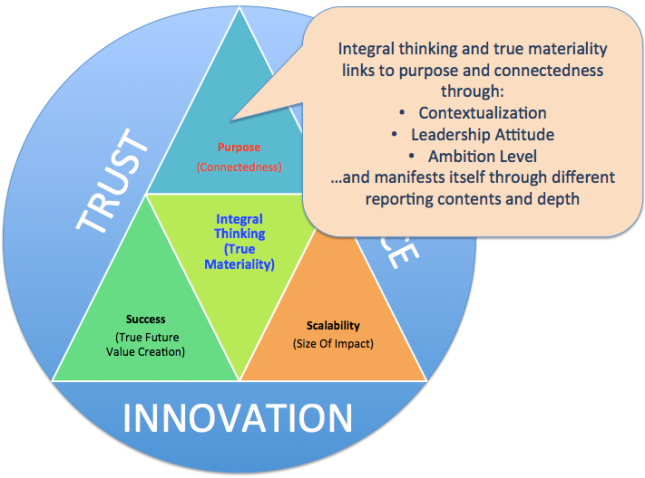

Diagram 3: Integral thinking and true materiality need a renewed focus on the purpose of the organization and connectedness to the economy we want to live in.

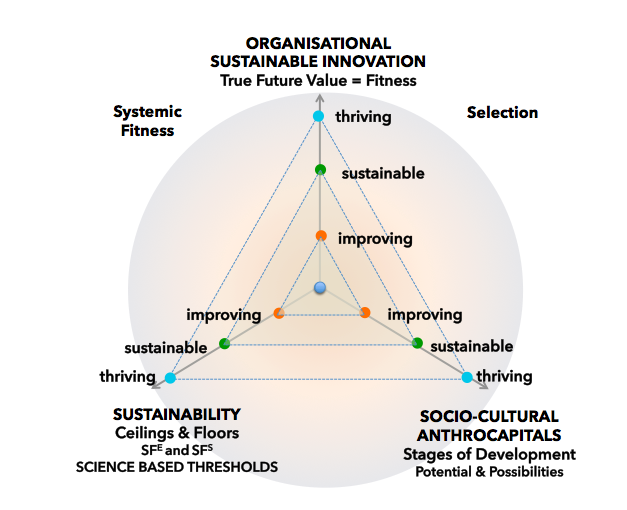

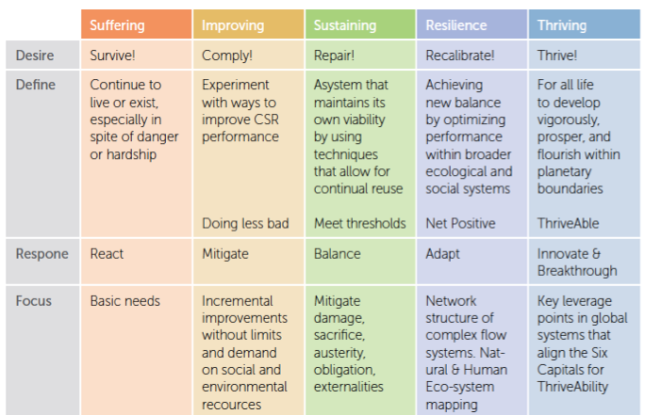

Diagram 3: Integral thinking and true materiality need a renewed focus on the purpose of the organization and connectedness to the economy we want to live in. Diagram 4: The strategy continuum to assess a company’s position in a world that needs to leapfrog from surviving to thriving (Source: A Leader’s Guide to ThriveAbility, page 18).

Diagram 4: The strategy continuum to assess a company’s position in a world that needs to leapfrog from surviving to thriving (Source: A Leader’s Guide to ThriveAbility, page 18).