This 7-part series has been first published on Sustainable Brands between late January and early March 2016 as a 6-part series and a follow-up by Bill Baue, co-founder of Convetit and the Sustainability Context Group. It captures the essence of my thinking I was able to gather through the extraordinary work of the Reporting 3.0 Platform, GISR and the ThriveAbility Foundation in 2015. What came out is a structure that I called a ‘new impetus embracing purpose, success and scalability for thriving organizations’. I am reposting the original 6 parts here and add a part #7 with reflections of others. This is part 4/7.

In this part of the series, we will focus on another very important aspect for the new reporting impetus that can serve the needs of a green & inclusive or regenerative economy – the question of how we define success. We are at this moment not able to truly claim when an organization is ‚sustainable’ (as laid out in stage 3 of the strategy continuum Diagram 4 in Part 3 of this series), and that just being ‚minimally good enough’ to indeed sustain the organization – and the real-world systems it operates within. Most reports aren’t giving a proper ‚world view’ or scenario context to their long-term targets.

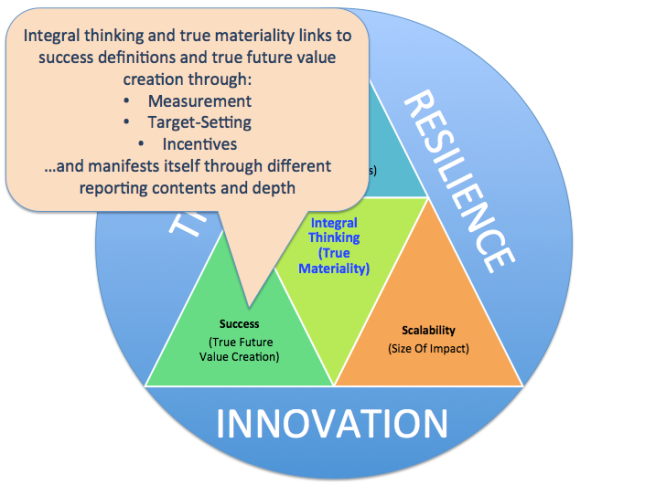

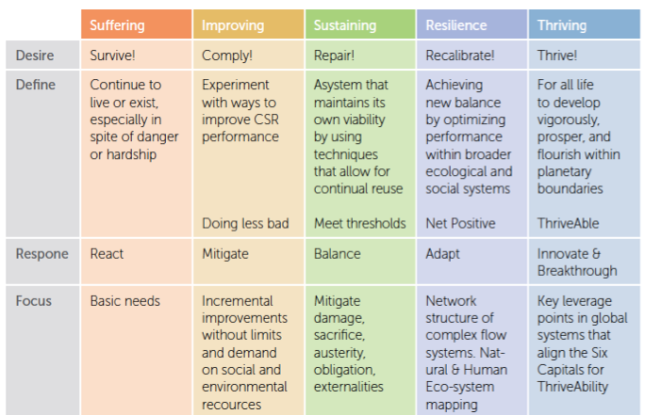

Diagram 5: Integral thinking and true materiality need a renewed focus on the definition of success to create True Future Value for the economy we want to live in.

Progress in defining ‚micro-macro’ links

Discussions in recent years show progress on defining ‚micro-macro’ links between companies’ impacts and the health of the broader systems they operate within. The elaborations about context-based reporting, science-based target setting, together with Kate Raworth’s Doughnut that defines environmental ceilings and social floors, has added vision and revealed depth as to the ‚devil in the details’ of measuring them in relation to the corporate context, and splitting them up into local, regional or global ‚allowances’, raising the profile of around thresholds and allocations.

Also, the link to the economic system thinking around the usefulness of GDP as the leading success factor has been called into question through the discussion around ‚Beyond GDP’, the Global Footprint Network, and the enhanced (yet mostly unconnected) indicator systems around National Sustainable Development Strategies of regions (like the EU). We see combinations of indices – e.g. country Ecological Footprints versus the Human Development Index – revealing the corridor in which countries should end up being sustainable. The problem here is that the ‚micro-macro’ link is not expressed at the corporate level, so companies take note of these data, but don’t know how to apply them in their specific case. The bigger and the more diversified a company is (crossing national borders), the more difficult it becomes.

The SDGs are an interim step to help fill that ‚micro-macro’ gap by dividing the global challenges into silo’ed aspects of problem articulation. There is merit to see the SDGs as a valuable attempt to induce companies to consider their contribution to a threshold through science-based goal-setting and context-based reporting. The problem is that, while the SDG areas are interconnected, the performance indicators aren’t. We already see companies start to think about picking and choosing some of the SDGs closest to them and define contributions they could make, without taking the step of developing a worldview (see Part 3 on purpose) that articulates responsibility for helping achieve the SDGs. We should not think that the SDGs will get us to any economic system transformation through voluntary contributions by the world’s millions and millions of companies. But without this transformation, there won’t be regeneration, let alone sustainability.

A stable solution for the next couple of hundred years?

We are in an experimentation phase, I fully admit, but I also claim that now is the time to not only set conventions for delivery indicators for the SDGs by 2030, but something that we can use for the next couple of hundred years, and that gets me to … accounting systems. Jane Gleeson-White already proclaimed the ‚third accounting revolution’ in her bestselling book Six Capitals, or can Accountants save the Planet?, cutting through double entry bookkeeping that was invented in the 15th century for the throughput economy, towards multi-capital bookkeeping. We now need an accounting system that prepares us for the green & inclusive economy.

The litmus test question of success that needs to be answered, both for each and every single SDG, and also as the basis to define what we will define below as ‘true future value’ simply is: does an organization have a license to grow by showing that it hasn’t built financial capital on the back of any other capital – or, quite the opposite, that it has built business models that regenerate all capitals? If yes, this would be sustainable, and possibly gross positive (ThriveAble) over time (stage 5 in the Strategy Continuum in Diagram 4 in Part 3).

In order to get there, though, we will need to renew our accounting system from double-entry to multi-capital-based. Why?

- Simply because accounting is how economies and executives, boards and supervisory boards tick and answer questions: is my company successful? Where can I be more efficient? Do I deliver on my purpose? On my targets? On my benchmarks? Did my incentives work? What information does controlling need from accounting? What can I externally assure? Interesting how shy our community is to create this missing reporting link – also for the SDGs. We sorely need accountants to raise their voices on the need for multi-capital accounting!

- A multi-capital accounting system aims to cover all sets of potential performance calculations: on SDGs, for context-based reporting, for science-based targeting, for value cycle efficiency. An outcome capital of the supplier can be an input capital for the next phase of such cycle, so it can serve as ‘docking station’ in a seamless review of value cycles – if all partners agree on the necessary convention on how to account and disclose in what the recently published UNEP Raising the Bar report calls “Collaborative Reporting”.

- The structure of multi-capital accounting gives space to the necessary formulation of conventions (that’s what an accounting system mainly is, it’s not a 100% accurate discipline) and structuring of the discussions we need to have: what can be monetized? Is it necessary to monetize everything? How to link to local/regional/global thresholds? E.g., water has a different, more local or regional threshold basis than carbon emissions. How to implement threshold based and capital-absorbing indicators into corporate dashboards, into national statistics, into a ‘global pulse’ of how we are doing altogether.

- Finally, the painful and often repeated mistake is that we think we can create indicators without proper data architecture in mind, where aggregation and disaggregation are possible and where slicing and dicing of information for multiple aspects is possible. A multi-capital based systematic approach can support that, like activity-based costing does in controlling for a long time.

Multi-capital accounting to create ‘True Future Value’

Multi-capital accounting shifts from measuring value to measuring ‘True Future Value’. The ThriveAbility Foundation adds a forward-looking focus on true future value, assessing not only the ongoing viability of the organization and the systems it operates in (science-based thresholds), but also its potential for breakthrough innovation to reduce (and ultimately eliminate) negative environmental footprints while maximizing and optimizing social handprint value creation. It uses 7 capitals, adding relational capital as a separate capital to the group of 6 capitals as proposed by the IIRC.

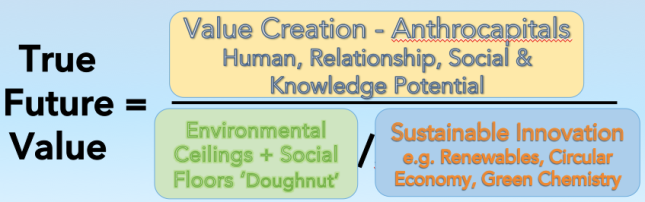

Diagram 6: High-level formula for deriving at ‘True Future Value’; a more detailed version with all variables can be sent by the author on request.

Diagram 6: High-level formula for deriving at ‘True Future Value’; a more detailed version with all variables can be sent by the author on request.

Here are some of the advantages of using a multi-capital basis to create ‘true future value’ (TFV) results:

- CONTEXT SENSITIVITY – TFV is a context-sensitive methodology, which works on the basis of progressive approximation to arrive at a best-estimate based decision. The context of the decision/s being made is the very first factor taken into account when applying the equation;

- TRUE BENEFIT/COST – TFV is a holistic equation that measures the ratio of the value created in any human activity through synergies between human, relational, social and knowledge capitals (or “anthrocapitals” that generate thriving and benefits), relative to the natural and manufactured capitals costs associated with that value creation activity;

- THREE CORE VARIABLES – TFV includes three key terms – on the denominator we have Science Based Thresholds (social floors and environmental ceilings) divided by a Sustainable Innovation Factor (including, for example, circular economy/C2C, green chemistry, renewable energy, biomimicry and micro-biome based innovations); and on the numerator we have the Value Creation Capacity of the anthrocapitals that generate thriving;

- ALL EXTERNALITIES INCLUDED – TFV includes both positive and negative externalities in terms of metrics that measure both impacts and value/thriving, in such a way that context based sustainability thresholds are honored;

- THRIVEABLE DECISION BENCHMARKS – TFV provides a benchmark for decisions of all kinds through which a “thriveable” decision can be made, taking into account a full seven-capital, multi-stakeholder analysis of the true costs and true benefits of a particular investment, program or action.

True Future Value as the Basis for a ThriveAbility Index

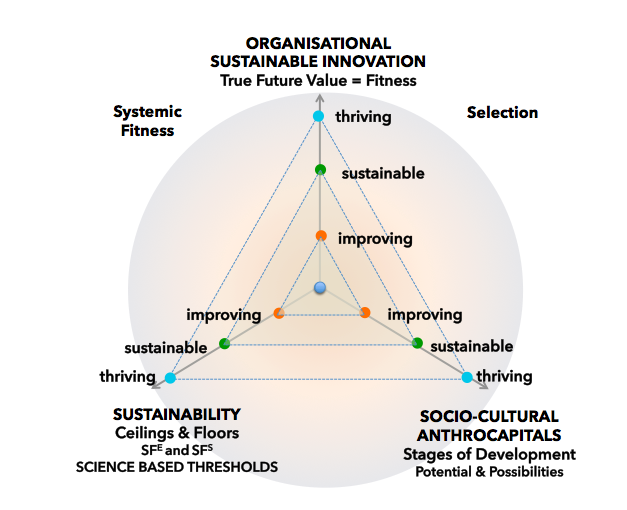

Going a step further, the ThriveAbility Foundation has designed the ThriveAbility Index model in which the components of the TFV are embedded (see Diagram 7).

This model picks up on the idea of the three gap model in Part 2 of this series, and measures the gap closure in all three dimensions, and by that explaining where an organization stands in the continuum from surviving to thriving. It represents a different way to assess and report on the overall fitness of an organization. This is a completely new quality in helping to define the profile and positioning of an organization in a three-dimensional fitness space and probably represents the most holistic performance measurement. The argument that ‘sustainability’ or ‘thriveability’ can’t be summarized in one indicator, something the sustainability community has always declared impossible (and by that has kept the interest of multiple financial market players on a low simmer), can be overcome. This high level fitness indicator, to be developed for 10 cluster industries through the ThriveAbility Foundation by 2017 to 2019 (with the aim the have it ready to use in 2020), can be disaggregated into its three components, used for True Future Value Creation of any contextual area of interest (such as the SDGs) and offers high potential for a new quality of corporate, city, country or global performance dashboards. It can be used by Rating Organizations to produce a new generation of sustainability or ThriveAbility fitness ratings. It can be used by regions (e.g. counties) or national statistics offices as a meta- performance structure.

Diagram 7: Three axis model of the ThriveAbility Index model that corresponds with the three gap model assessing progress in all the gap areas (Source: A Leader’s Guide to ThriveAbility, page 38).

Will we get there?

We may need new and different networks to build what’s needed. I fear the existing standard setters alone won’t cut it, the UN system alone won’t succeed, the governments alone won’t deliver, the accounting standard setters need support, IT companies needs an architecture meta-structure to work in consortiums and open source (liberated data), and the majority of corporations in the mainstream will anyway only respond to legal requirements or ‘cookbooks’ that give them a step-by-step delivery template.

Reporting 3.0, mentioned in Part 1, a networked community of several hundred interested individuals has recently proposed a set of blueprints to recommend the necessary ‘glue’ between those defining a green & inclusive economy and those in reporting, accounting, IT and new business models.

The ThriveAbility Foundation offers masterclasses, pilot projects and a multi-year business plan to deliver on TFV and the ThriveAbility Index and invites partners into the Index development.

GISR offers principles and an accreditation scheme to align with the principles, many of them in support to ingredients mentioned here for reporting and accounting. The Labs, one of the components of their CORE program, offer space for joint creation of the basics for thriveable ratings.

What to do in the short term?

So, let’s again imagine a sustainability and/or integrated report that showcases a reporting organization’s contribution through a success measurement involving a multi-capital accounting approach (e.g. as showcased by The Crown Estate, UK, in their integrated reports on Total Contribution). What would a reader expect to see answered? Here are examples of what I would find substantial in that area, taking into account that it still takes time to report back in a complete and structured manner as described above.

Measurement:

- To what degree does the company inventory shows its impacts from the different levels of its value cycles (instead of value chain, reflecting the need for a circular economy)?

- Is the internalization of external effects seen as part of a ‘True-Value-Screening’ an option to better understand the value-creation process?

- Does one differentiate between various capitals and are these integrated in the success measurement? Does the company therefore know its value-creation potentials and weaknesses better? Does the company address the consequences from these outcomes?

- Does the company identify one or more SDGs to align measurement methodology that looks at context-based or science-based thresholds, and does it aim to develop multi-capital assessments about their contributions to these SDGs?

- Does the company also collect data about the organizational transformation capacity and leadership capacity, taking into account the 3-dimensionality of achieving ThriveAbility, responding to the 3-gap-problem?

Target setting:

- Are there defined target corridors for the sustainable use of different capitals?

- Are ‘science-based-goals’ assessed and context used for connecting to ‘social floors’ und ‘environmental ceilings’ when targets are defined?

- How are long-term targets defined and then used to backcast mid- and short-term targets?

- How are data of organizational transformation and leadership capacity used in defining targets also for these categories?

- How are potential scenarios linked to target-setting?

Incentives:

- How does the company incentivize sustainable performance? How does it punish unsustainable performance? Is this based on the measurements as mentioned above?

- How does the company trigger and incentivize better leadership and transformational capabilities?

The combination of multi-capital approaches in internal accounting and controlling as well as external reporting, combined with experimenting their interconnections through True Future Value Calculations, and adding transformational and leadership capacity factors into measurement, target-setting as well as incentive structures, could help tremendously to report on the future readiness of an organization’s business model(s).

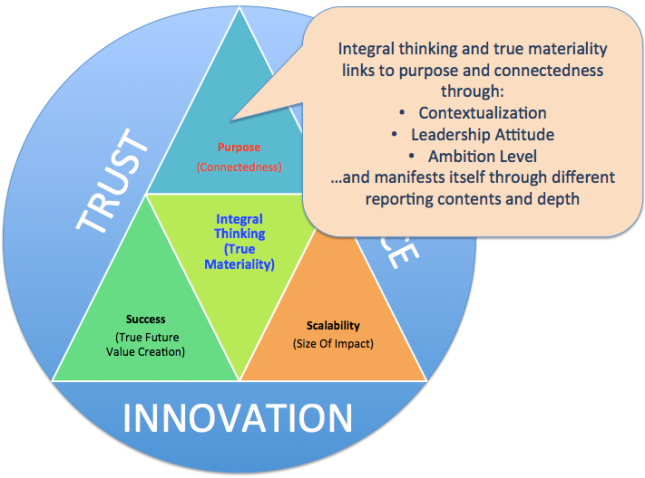

Diagram 3: Integral thinking and true materiality need a renewed focus on the purpose of the organization and connectedness to the economy we want to live in.

Diagram 3: Integral thinking and true materiality need a renewed focus on the purpose of the organization and connectedness to the economy we want to live in. Diagram 4: The strategy continuum to assess a company’s position in a world that needs to leapfrog from surviving to thriving (Source: A Leader’s Guide to ThriveAbility, page 18).

Diagram 4: The strategy continuum to assess a company’s position in a world that needs to leapfrog from surviving to thriving (Source: A Leader’s Guide to ThriveAbility, page 18).